The Art of Cryptocurrency Trading: Understanding the Psychology and Dynamics Behind Cryptocurrencies

In the world of cryptocurrency trading, there are many factors that come into play that can impact a trader’s success. While technical analysis is essential to making informed decisions, understanding the psychological aspects of trading and how market dynamics affect price movements is equally essential. In this article, we’ll dive into the psychology of cryptocurrency trading, explore the importance of market dynamics, and discuss the role of Proof of Work (PoW) in shaping the cryptocurrency market.

The Psychology of Cryptocurrency Trading

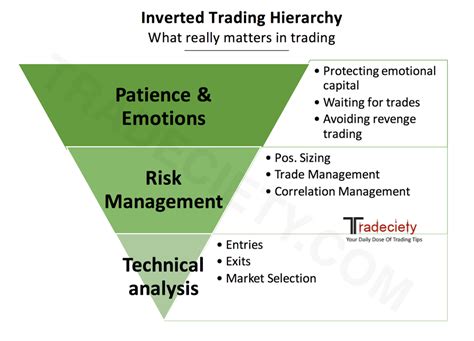

Cryptocurrency trading is a high-stakes game where emotions play a significant role. The psychological aspects of trading can be influenced by a variety of factors, including:

- Fear and Greed: Fear of missing out (FOMO) and greed for potential gains are common emotions that drive traders to make impulsive decisions.

- Loss Aversion: Traders often overestimate losses, making it difficult to cut their losses if they experience a significant drop in price.

- Information Overload: The large amount of data available in the cryptocurrency market can lead to analysis paralysis, as traders struggle to make informed decisions.

- Mental Accounting: Traders tend to hold losing positions for longer periods of time due to mental accounting, where they justify their losses by holding them longer than expected.

Market Dynamics

The cryptocurrency market is characterized by high volatility and rapid price movements. Market dynamics play a crucial role in defining market behavior:

- Supply and Demand: The balance between supply and demand determines the price of cryptocurrencies.

- Regulatory Environment: Changes in regulatory policies can have a significant impact on market behavior and direction.

- Network Effects

: As more people join the cryptocurrency ecosystem, network effects become a significant driver of price movements.

- Adoption Rate: High adoption rates can lead to increased demand, driving up prices.

Proof of Work (PoW)

Proof of Work (PoW) is a consensus mechanism used by most cryptocurrencies to secure their blockchain networks. Here’s how proof-of-work works:

- Crypto hash functions: Cryptocurrencies use cryptographic hash functions, such as SHA-256, to create a unique digital fingerprint for each block.

- Mining process: Miners compete to solve complex mathematical puzzles, using powerful computers to validate transactions and create new blocks.

- Block reward: The miner who creates the next block receives a reward in cryptocurrency, which is typically mined through an energy-intensive process.

The impact of proof-of-work on market dynamics

Proof-of-work has a significant impact on market dynamics:

- Energy consumption: The energy required to mine proof-of-work increases the carbon footprint of the cryptocurrency ecosystem.

- Scalability Issues: High network congestion can lead to scalability issues, making it difficult for new users to join the ecosystem.

- Volatility: Price fluctuations are more pronounced in the early stages of a cryptocurrency’s development as market participants adapt to its price.

Conclusion

Cryptocurrency trading is a complex dance between psychology and dynamics. Understanding the psychological aspects of trading, such as fear, greed, loss aversion, and information overload, can help traders make informed decisions. The importance of market dynamics, including supply and demand, regulatory environment, network effects, and adoption rates, cannot be overstated.

Proof-of-work is a critical component of many cryptocurrencies, shaping their market behavior and impact on the ecosystem as a whole. As the cryptocurrency market continues to evolve, understanding its psychology and dynamics will remain essential for traders looking to succeed in this high-stakes game.