Crypto Market Sentiment Analysis: Deep Diving Into Current Landscape

The world of cryptocurrency is constantly evolving, and one aspect that has received significant attention is lately is market opinion. In this article, we explore what analysis of a sense of encryption market means why it is important to understand it and how floor prices and pools can influence investment decisions.

What is the Crypto Market Analysis?

The opinion of the crypto market referers to the general attitude or mood of cryptocurrency and merchants. It covers different aspects as pressure, sales pressure, optimism, pessimism and euphoria. By analyzing these factors, the market parties can gain valuable views on market trends and make conscious decisions.

Why is Market Opinion Analysis Crucial?

Understanding the Feelings of the Market Is Vital for Several Reasons:

- Predicting Price Changes : A clear understanding of market opinions gives merchants to anticipate possible price fluctuations so that they can adapt their position accordingly.

- Risk Management : By identifying high purchasing pressure and sales resistors, investors can better control their risk exposure and avoid significant losses.

- Strategic Decision-Making

: Analysis of Market Sense of Market Helps individuals to make more conscious decisions about their investments, whether it is to buy or sell cryptocurrencies.

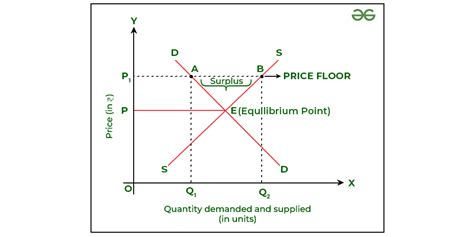

Floor Prices: Bottom Line

The floor price is a minimum price that offers the encryption currency for sale on the stock exchange. In other words, it is the lowest price at which buyers are reading to pay. The price of the floor may be affected by Different Factors Such as:

* The market supply and demand : When the market is over -trolled or there is a shortage of liquidity, floor prices usually rise.

* ACCEPTANCE RATES : IF More Merchants and Investors Enter the Market, they can raise prices due to rising purchase pressure.

* Regulatory Changes : New Regulations may affect Floor Prices as Merchants Adapt Their Strategy According to their.

Pool: Pool Effect

Pool is a Group of Cryptocurrencies that are listed in Several Exchanges at Different Price Levels. When it comes to swimming pool, several factors come into play:

* Price Dynamics : The pool usually has more stable price changes due to the diversification effect, as individual market forces affect prices instead of just one exchange.

* Market Efficiency : When buyers and sellers interact with multiple shifts, liquidity improves, which reduces the spread of Floor Prices.

combining the floor price

A number of strategies must be taken into account in terms of merging:

* Market Manufacturing

: Merchants Participate in Market Manufacturing Activities by Purchasing and Selling Coins at Different Price Levels. This helps to maintain liquidity and supports price stability.

* Fork Pools : Pools can be forgered or divided into lower film prices lower, allowing merchants to take advantage of price differences between the main pool.

Conclusion

Crypto marketing analysis is an important part of navigating the constantly changing cryptocurrency landscape. By understanding floor prices and merging strategies, investors can make more conscious decisions about their investments. Remember that market opinion is only one puzzle; It is necessary to combine this information with technical analysis, basic research and risk management techniques to achieve long -term success in the cryptocurrency world.

Other resources

* Cryptos Spectator : A platform that provides real -Time market information and views on a variety of cryptocurrency.

* CoinMarketcap : A comprehensive resource to track cryptocurrency prices, market value and trademets.