Fintech Border: Unlock the potential of cryptocurrency

While the world is becoming more digital, cryptocurrency has become the main player of the financial landscape. With the rapid growth and growing acceptance, it is not surprising that investors are looking for ways to benefit from this trend.

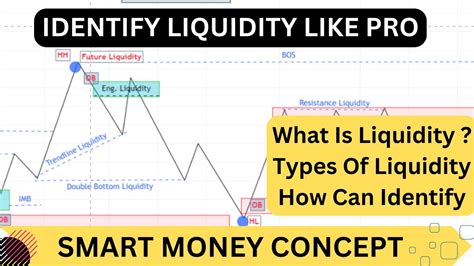

One of the aspects of trade in cryptocurrencies that has been paid to considerable attention in recent years is liquidity. Liquidity refers to the convenience at which the asset can be purchased or sold without a significant impact on its price. In cryptocurrency markets, merchants have a decisive high liquidity as it allows them to quickly cover and leave positions, which reduces the risk of significant losses.

In order to achieve high liquidity, merchants use a variety of strategies, including suspension orders, position sizes and market analysis. However, the popular method of gaining popularity has been isolated spare trading.

The isolated reserve consists of a certain active use as a guaranteed part of the trading, allowing traders to maintain control over their account while blocking liquidity. This approach offers several benefits, including reduced risk and increased elasticity.

For example, let’s say the trader wants to buy 100 Bitcoin units (BTC) with a busy BTC. To reduce losses in the event of a price drop, they can use isolated reserves to trade, blocking their position through a warranty. In this scenario, the merchant should deposit an equivalent amount of BTC as a guarantee while maintaining control of his initial investment.

Traders participating in cryptocurrency trade tenders also benefit from liquidity and isolation for benefits. These events combine the best traders from around the world, offering them a platform to introduce their skills and compete for prices.

A remarkable example is the Cryptoslam tournament, which has been held every year since 2017. The competition offers a variety of cryptocurrencies, including Bitcoin, Ethereum and Litecoin (LTC). Traders need to use separate reserve trading strategies to participate in the event without risking more than they can afford to lose.

While isolated spare trading offers significant benefits to traders, it is important to note that this approach has a risk place. For example, if the price drops significantly, the trader may not be able to recover losses, even if they have used isolated reserves.

In conclusion, liquidity and isolation are decisive aspects of trade in cryptocurrencies, providing investors with a quick entry and output strategy platform, while reducing the risk. While the market continues to develop, we can expect to see a new innovation in this area, stimulating growth and acceptance among traders.

Sources:

- “Liquidity Effects on Cryptocurrency Trade” CoinDesk

- “Isolated spare exchange on cryptocurrency markets” made by cryptoslate

- “Cryptoslam tournament: view of the best traders in the world” created by Cintelegraph